Understanding hail damage repair coverage is crucial as policies vary among insurers. File a claim with your insurer after assessing hail damage. An appraiser will inspect and ensure repairs meet standards. Be aware that warranties often exclude pre-existing conditions, which could impact claim eligibility and out-of-pocket expenses.

Hail damage repair is a common concern for vehicle owners, especially in regions prone to severe storms. Understanding how hail damage repair impacts insurance claims and warranties is crucial for car owners looking to minimize costs and protect their investments. This article delves into three key areas: understanding coverage for hail damage repairs, navigating insurance claims processes, and assessing the effect on vehicle warranty validity. By exploring these aspects, drivers can make informed decisions when dealing with hail damage.

- Understanding Hail Damage Repair Coverage

- Navigating Insurance Claims for Repairs

- The Impact on Vehicle Warranty Validity

Understanding Hail Damage Repair Coverage

When it comes to understanding hail damage repair coverage, it’s crucial to recognize that policies vary significantly between insurance providers. Hail is a common natural occurrence that can cause substantial damage to vehicles, from dented panels to shattered windshields. Many standard auto insurance policies include some form of coverage for hail damage, often as part of comprehensive or collision coverage. This means if your vehicle sustains hail damage, you may not have to bear the full cost of repair.

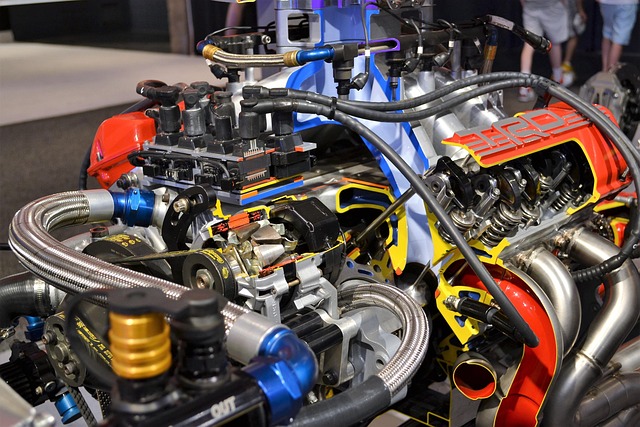

Automotive body work due to hail damage is typically covered by insurance companies, but the specifics depend on your policy’s terms and conditions. An automotive body shop will assess the extent of the damage and provide an estimate for repairs, which can range from minor dents and dings to complete panel replacements. In some cases, especially with severe hail events, vehicle repair may be a complex process involving multiple parts and systems. Knowing your coverage and working with a reputable automotive body shop ensures that you receive the necessary repairs while adhering to your insurance provider’s guidelines.

Navigating Insurance Claims for Repairs

Navigating insurance claims for repairs after hail damage can be a complex process. It’s important to understand your policy and rights as a vehicle owner. The first step is to contact your insurance provider to file a claim, providing detailed information about the extent of the hail damage. After the initial assessment, the insurance company will either approve or deny the claim, offering a settlement for the repair costs.

Many insurance policies cover hail damage repairs, but the process varies among companies and coverage types. Some may require you to visit an approved car body shop for repairs, while others might offer direct payments to a vehicle body repair center of your choice. In the event of a claim, a designated appraiser will inspect the vehicle, assess the damage, and determine the necessary repairs, ensuring that all work aligns with industry standards.

The Impact on Vehicle Warranty Validity

When a vehicle suffers from hail damage, it raises questions about the validity of its warranty. Many modern cars come with comprehensive warranties that cover various repairs and maintenance for a set period. However, the presence of hail damage could complicate matters. Most warranties explicitly state that any pre-existing conditions, including dents and scratches, are not covered. This means that if a car has hail damage and subsequent repair involves auto body services or dent removal (like paintless dent repair), the warranty might not apply to those specific costs.

This scenario underscores the importance of understanding the warranty terms before filing an insurance claim for hail damage repair. Insurers often assess the extent of the damage and may recommend different solutions, such as simple dent removal techniques or more extensive auto body repairs. Regardless of the recommended course of action, vehicle owners should be aware that these decisions can impact their warranty eligibility, potentially resulting in out-of-pocket expenses they weren’t anticipating.

Hail damage repair plays a significant role in navigating insurance claims and understanding vehicle warranty policies. When it comes to repairs, knowing your coverage and the potential implications for your warranty is crucial. By understanding these aspects, car owners can efficiently manage hail-related damages, ensuring they receive the necessary repairs while making informed decisions regarding their insurance claims and warranty rights. This knowledge empowers them to protect their investments and maintain their vehicles in optimal condition post-hail event.