Hailstorms cause significant property and vehicle damage, requiring complex hail damage repair processes. Many home insurance policies cover such repairs, with coverage limits and deductibles to consider. Efficient navigation of the claims process involves prompt reporting, documentation, and thorough assessment by an adjuster. Auto body shops offer specialized services like paintless dent repair for swift and cost-effective restoration.

In the face of unpredictable weather patterns, understanding the role of insurance in covering hail damage repair costs is crucial. Hail storms can leave a trail of destruction, causing significant property damage, particularly to rooftops and vehicles. This article delves into the impact of hail damage and explores how insurance policies step in to assist homeowners and business owners with the costly repairs. We’ll guide you through the process of filing claims, ensuring efficient and timely restoration after a hailstorm.

- Understanding Hail Damage and Its Impact

- Insurance Coverage for Hail Damage Repair

- Navigating Claims Process for Efficient Repairs

Understanding Hail Damage and Its Impact

Hail damage can have a significant impact on both residential and commercial properties, leading to costly repairs. Hailstorms, with their relentless force, leave behind a trail of destruction, including dented roofs, shattered windows, and damaged exterior cladding. Understanding the extent of this natural phenomenon is crucial in appreciating the need for adequate insurance coverage. Hail damage repair is not merely about fixing superficial marks; it often involves intricate work to ensure structural integrity and protect against future risks.

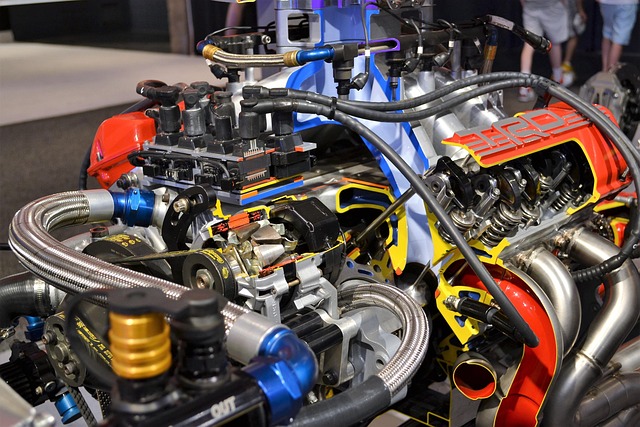

In the context of vehicle repair services, hail can cause extensive harm to cars, trucks, and other vehicles. collision repair services specialists are well-equipped to handle these challenges, offering expertise in restoring vehicles to their pre-damage condition. An auto repair shop’s role becomes vital in mitigating the financial burden associated with hail damage repair, providing peace of mind for policyholders during times of weather-induced crises.

Insurance Coverage for Hail Damage Repair

Many standard home insurance policies cover hail damage repair to your property, including roofing and siding. This is especially important in regions prone to severe weather events like hailstorms. When such storms occur, they can cause significant car damage repair needs, from dented car bodies to shattered windshields.

Insurance companies typically provide compensation for the cost of fixing or replacing damaged items due to hail. Policyholders should review their coverage limits and deductibles to understand how much financial support they’ll receive during hail damage repair. It’s crucial to document all repairs with photos and receipts, as this information will be essential when filing an insurance claim at a reputable car repair shop.

Navigating Claims Process for Efficient Repairs

Navigating the claims process for efficient hail damage repairs is crucial for property owners and business operators alike. The first step involves contacting your insurance provider to report the incident promptly, ensuring detailed documentation of all visible damages. This includes taking clear photos or videos of affected areas, as these will be essential in supporting your claim.

During the assessment phase, an adjuster from your insurer will visit the site to inspect the damage firsthand. They’ll evaluate the extent of the hailstorm’s impact on your property and determine eligibility for coverage based on your policy terms. For auto body shop owners, this process can significantly influence their operational continuity. Prompt claims handling allows businesses to initiate repairs swiftly, minimising downtime and potential revenue loss. Many modern auto maintenance facilities also offer services like paintless dent repair, which can further expedite the restoration process while keeping costs down for both customers and insurers.

Insurance plays a pivotal role in mitigating the financial burden of hail damage repair, offering peace of mind and ensuring efficient restoration. By understanding their policy coverage and navigating the claims process effectively, homeowners can expedite repairs and minimize out-of-pocket expenses associated with hail damage. Prompt action and thorough documentation are key to leveraging insurance benefits for seamless hail damage repair.